How a Bank transitioned its staff to work from home and remain productive during the Pandemic: Case Study

November 10, 2020The Pandemic put most businesses in a tailspin, with new rules around distancing and working from home. Covid-19 could never have been anticipated and the impact it has had on multiple businesses has been phenomenal. Some businesses have completely closed-up shop and some plunged headfirst into a digital transformation investment.

Our client had to transition into a remote workforce because of the Covid-19 pandemic given the stay-at-home order. Pre Covid-19, all staff was functioning in one building and there were no plans or policies in place for remote work. Because the Bank provides an essential service, it was imperative that staff should be able to continue functioning even from remote locations. We were tasked with finding a way for them to seamlessly access their data and perform their duties.

THE CHALLENGE

- How do we deploy a solution that allows for an easy transition while flattening the learning curve within a short space of time?

- We also needed to ensure the weekly company meetings were maintained as this provided an opportunity for all employees to meet and give management the opportunity to provide company–wide updates on the overall progress or targets.

OUR RECOMMENDATIONS

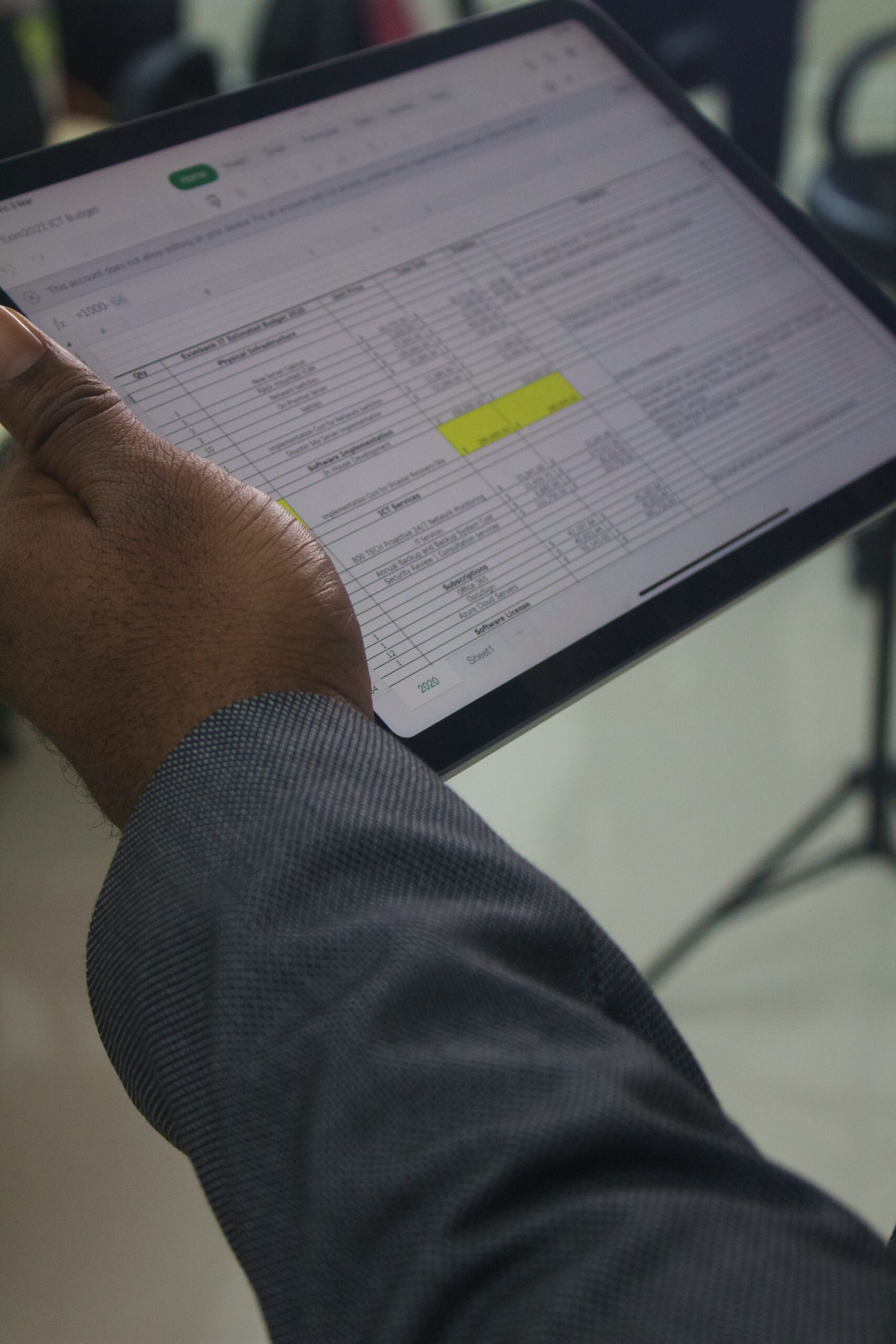

800-Tech recommended Microsoft Power Platform Solution that would allow the client to perform their functions remotely. The client needed to purchase subscriptions for some of the tools while others were configured to enable the staff to work remotely.

The following tools were deployed to assist with the transition-:

- Microsoft Remote Desktop Service

- Microsoft Teams

- Microsoft SharePoint

- Microsoft PowerApps

- Microsoft Power Automate

THE SOLUTIONS

We responded by deploying SharePoint modern workspaces for the various departments and specialized departmental units.

This allowed the Bank to have access to their files remotely with coauthoring features which increased departmental collaboration. Remote Desktop Service was configured to allow remote access of the core banking application by users, allowing secure processing remotely with availability 24/7.

To ensure the weekly company meetings were maintained, we recommended the use of Microsoft Teams video conferencing features ensuring all company meetings were transitioned digitally with weekly recurring schedules configured. The Microsoft Teams sites were configured in tandem with Microsoft SharePoint to allow unification of the modern workspaces. We also configured Power Automate which delivered documents via email for approvals and created business process workflows.

THE RESULTS

These initial steps provided a solid foundation for our client to begin their Digital Transformation process. 800-TECH was able to get the Bank online within seven days. As with each client, we performed an IT Audit to determine what solutions are already in place and where we needed to bridge the gaps.

With this client, they already implemented some of our recommended programs and solutions so we were able to transition them to working remotely with the seven-day timeframe.

In addition to being able to work from home, the client saw

- An increase in productivity as reported by the management team

- Increased efficiency from members of staff

- 80% increase in application processing

- Motivated staff because of the flexibility

They were able to meet all their deadlines and all requirements.

We faced the biggest hurdle getting the staff acclimated to working from home, however we were able to help make this process smoother by providing training on programs that were more complex.

NEXT STEPS

We are continuing the digitizing process for this client with a focus on automating processes that are still being done manually to further increase efficiency within the organization.

With COVID-19 affecting us all, this automation process has become more accelerated. Therefore, we are continuing to provide the solutions that allow our clients to function with the highest level of productivity possible.

We can provide you with an audit of your business processes to determine what you can do to streamline and enhance the functioning of your organization.

Contact us to schedule your audit.

Our Blog

Exciting Update: Our New Commitment to Cybersecurity for SMEs

We're thrilled to announce a significant transformation in our services! Starting January 2024, we have shifted our focus from general technology support to a specialized commitment to cybersecurity for small and medium-sized enterprises (SMEs). This strategic change...

Elevating Your Cybersecurity

In an era dominated by technology, cybersecurity isn't just a buzzword; it's a critical necessity. The modern business landscape demands a proactive approach to protecting your data and infrastructure from an ever-evolving threat landscape. ? Why You Need to Take...

Innovative Solutions for Enhanced Productivity!

A valued client recently approached us with a unique challenge: the need to boost employee productivity while ensuring accurate time and billing management. They'd explored various off-the-shelf solutions but couldn't find one that perfectly aligned with their...

The Power of Structured Databases: Why Excel Isn’t Always the Best Choice

While Excel remains a valuable tool for basic data organization, it may not always be the optimal choice for storing and collating large, complex datasets. Structured databases offer scalability, data integrity, security, efficient analysis, collaboration, and long-term maintenance capabilities that can enhance productivity and enable data-driven decision-making.

Unleashing Business Potential: Join Us to #BridgetheGap and Experience Positive Transformation

At 800 TECH, we believe in empowering businesses to unlock their full potential and bridge the gap to a more streamlined and successful future. By joining forces with us, you can experience a range of positive transformations that will propel your business towards new...

Transforming Trinidad and Tobago’s Financial and Export Sector with 800-TECH

Once upon a time, in the vibrant financial and export sector of Trinidad and Tobago, an organization had been making its mark for over three decades. As a pioneer in the industry, they faced the challenge of outdated technology that hindered their operations. It was...

Bridging the Gap: Conquering Technology Fears – A Three-Step Strategy

In today's rapidly evolving digital landscape, the divide between technology and businesses has become a significant challenge, particularly in the financial sector. Many businesses are hesitant to embrace technology due to their fear of the unknown. While financial...

Safeguarding Your Business Secrets with Technology: A Strategic Approach for Business Owners

As business owners, we often become consumed by the day-to-day operations of our companies. Inadvertently neglecting the technology that drives our businesses forward. However, it is crucial to recognize the significance of managing deployed technology, safeguarding...

A simple way to automate your petty cash

“Petty cash is simply any physical cash your business keeps on hand to pay for small, unplanned expenses.” A simple way to automate your petty cash is by using our E-Flow solution. E-Flow helps to automate this process and ensures every purchase is tagged...

Data Protection Services – The 3 Pillars

Let's look at how you can safeguard all of the data you have collected because this is the pulse and lifeblood of your organization. There are three pillars that we utilize in the deployment of our Data Protection Service. They are: Prevention Mitigation...